Home » Credit Score »

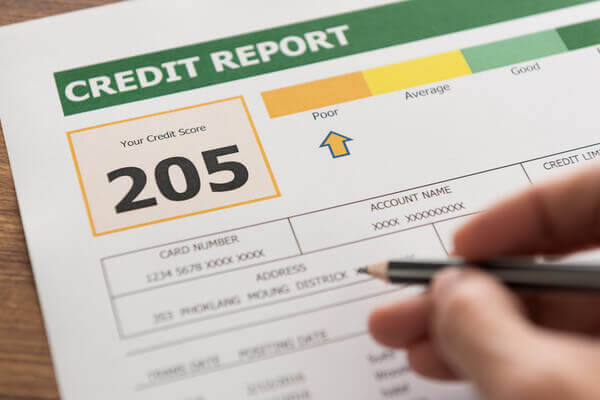

If you have bad credit, few things are more tempting than a quick fix that promises to repair your credit and instantly increase your credit score.

But beware, a company that offers to instantly repair your credit or increase your credit score to a specific number is almost certainly a credit repair scam that will be happy to take your money but won’t deliver the promised results.

Credit repair and credit-score scams often make promises that sound too good to be true – because they are. Red flags that will help you spot a credit repair scam include promises to increase your credit score to specific number; an offer to remove negative information from your credit report, even if it’s accurate and current; warnings not to contact credit reporting agencies directly; advising you to make false statements on loan applications; asking for upfront payment.

A credit repair company is not legit if it charges you an upfront fee or doesn’t advise you of your rights regarding credit repair. Credit repair companies that are legit are required by federal law to give you that information.

Credit repair scammers know that being in debt puts you in a vulnerable position, and they take advantage of it.

There are easy ways to spot a credit repair scam. There are also ways to improve your credit score and repair credit on your own, for free, or with the help of a nonprofit credit counseling agency that won’t scam you.

Signs of a Credit Repair Scam

While not all credit repair scams look exactly the same, many share many red flags. If any of these are true, steer clear:

- They make guarantees about increasing your credit score to a specific number or eliminating all of your debt.

- They request payment up front.

- They don’t inform you of your rights or tell you about things you can do yourself, for free, to improve your credit.

- They tell you not to contact credit bureaus.

- They tell you to apply for an Employer Identification Number (EIN), instead of using your Social Security number, in order to create a “new” credit report.

- They tell you to do things that are illegal, like creating a new identity; or unworkable, like disputing all information in your credit report, even if it’s timely and accurate.

Most of the legitimate things these companies can do for you, you can do yourself, for free, or with the help of a nonprofit credit counseling agency.

Your credit score and credit report are reflections of how you use credit. Changing the way you handle credit is the best way to improve it. You can save more than $1,000 simply by knowing how to read a credit report, creating a budget, understanding how credit is scored and figuring out your own credit repair plan.

Signs of a Reputable Credit Repair or Credit Counseling Agency

Now that you know what credit repair and credit score scam red flags are, it’s easier to determine if a credit repair company is legit.

Nonprofit credit counseling agencies are required by law to look out for the best interests of the consumers who seek their help. They also must conform to strict rules about what they must tell you and what they can’t say. Here are the signs of a reputable credit counseling agency:

- They will tell you what your rights are regarding credit repair, including the fact that you can challenge information in your credit report by directly contacting the credit bureaus.

- They’ll tell you that while you can pay for credit repair, you can also do it yourself for free.

- The counselor will review your finances with you before helping you develop a strategy to improve your credit. The credit repair agency can’t know how to improve your credit until they know your credit history. They will go over your credit report with you before suggesting ways that you can improve your credit and increase your credit score.

- They won’t make promises or guarantees they can’t keep. An example of a false promise, and one you won’t hear from a legitimate agency, is a guarantee to raise your credit score by a specific number of points. A reputable credit counselor will, however, show you how other customers improved their credit.

Know Your Rights When Working with Credit Repair Agencies

The federal Credit Repair Organizations Act spells out consumer rights as well as how credit repair companies are required to behave. These laws were put in place to keep consumers struggling with debt from being taken advantage of by credit repair scams and companies that exploit vulnerable customers.

Your rights include:

- A written contract that spells out your rights and explains the services the company will perform.

- Informing you that you have three days to cancel the agreement after signing it, with no charge.

- An estimate on the amount of time your plan will take.

- Total cost and an explanation of any guarantees.

- Companies are prohibited from making untrue or misleading representations.

- They are barred from demanding advance payment.

Remember that you can not get accurate information removed from your credit report, even if it’s negative. Negative information stays on your credit report for a certain amount of time – for instance, a bankruptcy will stay for seven to 10 years. There is no way to get it taken off, and telling you there is an example of the “misleading representation” that the law prohibits.

If there is information on your credit report that’s incorrect, you can get it removed yourself, free of charge, by contacting the credit reporting bureaus.

Choosing a Reputable Credit Repair Agency

When choosing a credit repair agency, there are some overall points to keep in mind:

- Up-front fees are a red flag. The initial consultation with a reputable credit repair company is always free.

- Reputable firms provide counseling and education – along with debt consolidation options and credit payment services – so consumers can lower their debt and achieve financial stability.

- Nonprofit credit counseling agencies are a fiduciary, which means they’re required by law to act in your best interest.

Find a company that works with you to increase your financial literacy – in other words, helps you understand how to manage finances and set up a spending budget, what your debt management options are and how to access your credit report and understand your credit score. All this information is offered for free by most nonprofit credit counseling agencies.

Do Your Credit Repair Homework

Don’t be afraid to ask questions before agreeing to a plan. It is your credit, your money and your future, and a legitimate credit repair agency, or credit counselor, will recognize that.

Before paying a fee or entering an agreement with a credit repair agency, check the website of your state attorney general’s office, the Federal Trade Commission or the Better Business Bureau to see if there are any complaints against the company.

The National Foundation for Credit Counseling and the U.S. Department of Justice list reputable credit counselors that can help you take charge of your debt and finances.

Reporting Credit Counseling and Credit Repair Scams

Federal and state governments, as well as consumer watchdog groups, want to know about credit repair scams, and they make it easy to report them. Most have online forms that can be filled out to report credit repair and other scams. Law enforcement and other agencies that investigate scams will take any information you have, and you can report the same scam to as many agencies as you want to.

Report scams to:

- The Federal Trade Commission

- Consumer Financial Protection Bureau

- Better Business Bureau

- Your state attorney general’s office

Other Options for Repairing Credit

There is no quick fix for repairing credit, but that doesn’t mean it can’t be done. You have the power to pay down debt and build better credit. Making on-time payments and lowering balances are the best things you can do to repair your credit and increase your credit score.

If you are struggling to pay off credit cards, or need support or financial education, there are ways to do that without spending a lot of money or getting duped by a credit repair scam.

Military members can get credit counseling and find options to repair credit through:

- Debt consolidation loan: A low-interest loan to pay off your high-interest debt can reduce monthly payments, as well as how much you owe in the long run. If your credit isn’t good enough to qualify or to get a good rate, consider asking someone with good credit to co-sign.

- Debt settlement: A debt settlement company negotiates with creditors to get them to agree to settle a debt for less than what you owe. This can be as much as 50% of the balance. Debt settlement has a negative impact on your credit score, which means future loans, if you are approved, will have higher interest rates. The IRS will also consider the forgiven balance, if it’s higher than $600, as income, so you will have to pay taxes on it. For-profit debt settlement may also have high fees. Some nonprofit credit counseling agencies also offer nonprofit debt settlement for those who meet qualifications.

- Debt management: A credit counselor can help you create a debt management plan that, unlike debt settlement, pays the full balance you owe over 3 to 5 years. It lowers how much you pay monthly, as well as how much you pay overall, because the nonprofit credit counselor works with your creditors to lower interest rates on your credit cards and loans. You make a monthly fixed payment to the credit counseling company that meets your budget, and the company makes monthly payments to your creditors. Debt management includes a monthly fee of $30-$50, as well as a small start-up fee.

Whatever credit repair option you choose, it is ultimately up to you to repair your credit. Making on-time payments, lowering balances and staying on track and making good choices to get credit repair help are the best solutions.

Sources:

- Better Business Bureau (2020, November 10) BBB Scam Alert: Credit Repair and Debt Relief Scams. Retrieved from https://www.bbb.org/article/scams/23372-bbb-tip-credit-repair-and-debt-relief-scams

- Fay, M. (2022, February 3) Recognizing a Credit Repair or Credit Counseling Scam. Retrieved from https://www.debt.org/credit/counseling/scams/

- N.A. (2017, June 8) How Can I Tell a Credit Card Repair Scam from a Reputable Credit Counselor? Retrieved from https://www.consumerfinance.gov/ask-cfpb/how-can-i-tell-a-credit-repair-scam-from-a-reputable-credit-counselor-en-1343/

- N.A. (2018, February 2) What is Credit Counseling? Retrieved from https://www.consumerfinance.gov/ask-cfpb/what-is-credit-counseling-en-1451/

- N.A. (2022, March 24) Credit Repair Scams. Retrieved from https://www.aarp.org/money/scams-fraud/info-2019/credit-repair.html

- N.A. (ND) Credit Repair Scams. Retrieved from https://consumer.ftc.gov/articles/credit-repair-scams

- N.A. (ND) Credit Repair: How to Help Yourself. Retrieved from https://consumer.ftc.gov/articles/credit-repair-how-help-yourself

- N.A. (ND) Credit Repair Organizations Act. Retrieved from https://www.ftc.gov/legal-library/browse/statutes/credit-repair-organizations-act